Social Security Earnings Limit 2025 Over 65. Qualified workers are entitled to retirement benefits at age 62. It changes year to year, but in 2025, that limit is $21,240.

For example, if you retire at full retirement age in 2025, your maximum benefit would be $4,018. Social security recipients that will attain fra during the year will have $1 in benefits withheld for every $3 in earnings above the upper limit.

What is the Minimum Social Security Benefit? Social Security Intelligence, The maximum social security retirement benefit in 2025 will be $5,108 per month, or the equivalent of $61,296 per year.

2025 Social Security Earned Limit Ann Elsbeth, Social security's retirement earnings test amounts will increase in 2025.

2025 Social Security Earned Limit Ann Elsbeth, Social security will deduct $1 for every $3 you earn above a higher annual limit in the year you reach your fra.

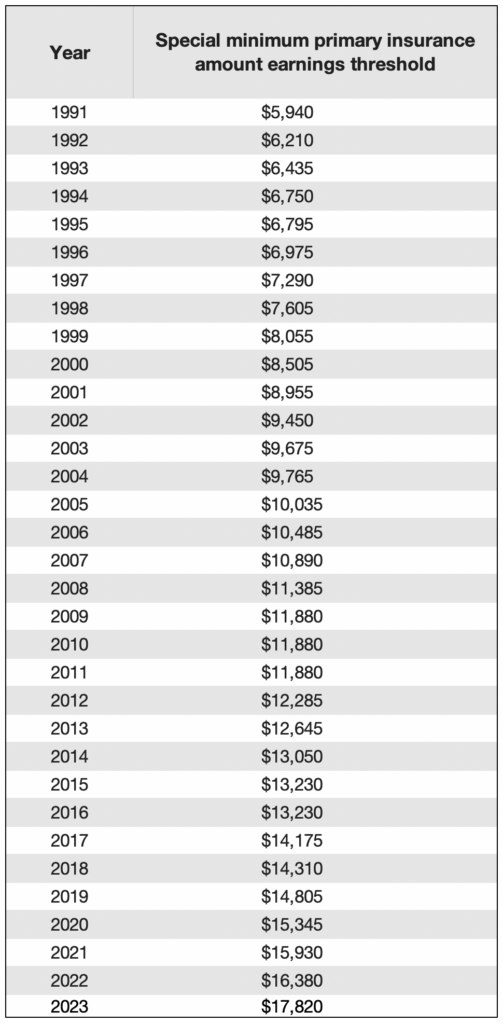

Social Security Wage Limit 2025 Base Manuel Easton, The special rule lets us pay a full social security check for any whole month we consider you retired, regardless of your yearly earnings.

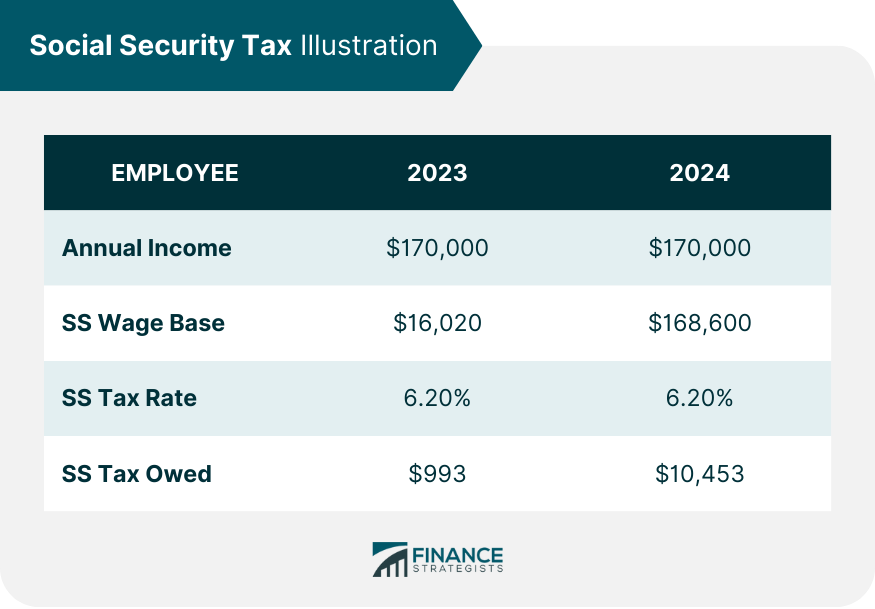

Medicare Tax Limit 2025 For Social Security Samuel Faris, For earnings in 2025, this base is $176,100.

Medicare Tax Limit 2025 For Social Security Samuel Faris, But before that point, you need to understand everything.

Social Security Wage Limit 2025 History Gloria C Green, There is no earnings cap after full retirement age.

Social Security Withholding 2025 Max Lekaren Calvin Qasim, For every $2 you earn above this limit, your benefits will be reduced by $1.

Social Security Withholding 2025 Max Lekaren Calvin Qasim, Here's who can expect to receive that much next year.

If you are retired or over age 65 and receive more than this amount, If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $62,160.